News Corporation Tax

Corporation Tax Ireland: 15% Tax Rate

Why an increase in Corporation Tax?

In October 2021, members of the Organization for Economic Co-Operation and Development (OECD)/G20 Inclusive Framework worked on a global consensus-based solution to reform international corporation tax. It resulted in a global agreement of 137 jurisdictions including Ireland. The proposal was made up of two key global tax initiatives referred to as Pillar 1 and Pillar 2. Pillar 1 addresses the partial re-allocation of taxing rights. This will result in the taxing rights being shifted towards the country of consumption rather than the country where the company is located. Some jurisdictions have already sought to impose digital taxes in advance of this measure. Pillar 2 addresses the minimum level of taxation applied on profits of multinational enterprises. After some initial negotiations around the wording of the minimum tax, ensuring the words “at least” 15% were removed to avoid future rate creep, Ireland agreed to adopt the minimum corporation tax rate of 15% for certain large multinationals. However, the proposed tax increase will only apply to any domestic and international group with a combined financial revenue of over €750 million a year.Timing of new Corporation Tax Rate

With the EU presidency currently sitting with France they had pushed for EU States to implement the minimum tax rate quickly. However, the approval for this would need the unanimous support of all 27 States and recently Poland, Sweden, Estonia, and Malta have raised their reservations until a clear position has been taken by the US. With Ireland in agreement to the proposal, Paschal Donohoe (Minister for Finance) wishes to legislate the bill for the beginning of 2023. However, with pushback from these other EU nations, suggestions have been made to change implementation to 2024 to allow companies time to adapt. French Minister for Finance Bruno Le Maire intends to readdress the proposal in April.Impact for Ireland

Given the new rate will only impact large multinational groups with turnover in excess of €750m, Ireland’s 12.5% corporation tax rate will primarily remain intact. How the increased rate will affect Ireland’s FDI will be watched with interest. The government have stated projected figures of €2billion being the decrease in tax revenue arising from the increase tax rate. Ireland has been at the forefront of all recent international tax reforms introducing items such as interest limitation rules, anti-hybrid measures and increased transfer pricing focus. These items, along with Trump tax reforms in the US, had all led to anticipation of Ireland’s FDI being impacted which did not materialise to any significant level. Roberts Nathan’s Tax Partner, Brendan Murphy brendan.murphy@robertsnathan.com is available to discuss all aspects of Ireland’s position on international tax reform.RN Podcast: 2021 – What is in store for the Irish tax landscape in the year ahead

UK Budget

Some Highlights of Budget 2020

- Income tax rates and bands and the USC rates and bands remain unchanged. The Minister for Finance did not want to commit to personal tax cuts in the lead up to a no-deal Brexit.

- The Home carer credit has increased to €1,600 and the Earned income credit has increased to €1,500.

- The Group A threshold for CAT has increased from €320,000 to €335,000. The increased threshold applies to gifts or inheritances received on or after 9 October 2019.

- There was no mention of employer’s PRSI however Budget 2019 announced this would increase from 10.95% to 11.05% from 1 January 2020. Employer’s PRSI has steadily increased over the last few years and represents a significant cost to businesses.

- SARP relief and the Foreign Earnings Deduction have been extended to 31 December 2022.

- In 2018, the Government implemented a 0% BIK rate for electric vehicles subject to a value limit of €50,000 in comparison to a rate of 30% of the car’s original market value for non-electric vehicles. This initiative has been extended to 2022.

- An increase in the credit from 25% to 30%.

- The ability to claim the credit on qualifying expenditure before the company commences trading. It should be noted that any credit claimed in this period can only be offset against VAT and payroll liabilities.

- An increase in the outsourcing limit applicable to third level institutes from 5% to 15%.

- Farm restructuring relief, a capital gains tax relief due to expire at the end of this year, has been extended to 31 December 2022.

- Several amendments will be made to the KEEP scheme to incentivise take-up in the scheme. This includes a change in the definition of a qualifying company so that the scheme applies to group structures and a change in the definition of a qualifying individual so that it applies to part-time and flexible employees.

- EII relief, an income tax relief for individuals who invest funds in certain companies, will also undergo changes which apply from yesterday. The amendments will allow individuals to claim full relief in the year of investment and the annual investment limit will increase from €150,000 to €250,000.

- The Minister for Finance announced there will be a significant overhaul to the DWT regime. From 1 January 2021, real-time date collected under the new PAYE Modernisation regime will be used to create a personalised rate of DWT on distributions received by individuals. In the meantime, an increase in the DWT rate from 20% to 25% will apply from 1 January 2020.

SME’s Welcome Changes to Subsistence Allowance Rates

- Employees and directors can now claim back an additional 10% of the costs incurred completely Tax Free while travelling on business.

- The cost to companies is considered to be an allowable expense for Corporation tax purposes, meaning it can be deducted from taxable profits.

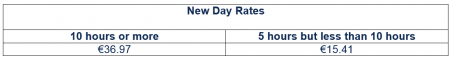

- The daily subsistence ‘5 Hour but less than 10 Hour’ rate increases by 10%.

- The daily subsistence ‘10 hours or more’ rate increases by 10%.

- The increases are in line with the Consumer Price Index.

- The revised standard rates of subsistence allowance are effective from 1 July 2019.

What remains unchanged?

What remains unchanged?

- The standard overnight rate will not be increased.

- A separate Vouched Accommodation (VA) rate continues to apply whereby employees encounter difficulties in sourcing suitable accommodation in Dublin.

For more information please contact a member of our team or email us at info@robertsnathan.com

For more information please contact a member of our team or email us at info@robertsnathan.com Apple, Ireland and the USD $13,000,000,000 Plus!

The European Commission (EC) is sticking to its guns regarding its state aid investigation into the Corporation Tax arrangements of Apple in the Republic of Ireland.

As everybody knows at this stage, Ireland has been ordered to recover up to €13 billion of state aid from Apple relating to a ten year review period. It is estimated that when interest is applied to this sum, the final amount due by Apple to the Irish Exchequer will be in the region of €19 billion.

Both Apple and the Irish Government have confirmed that they strongly disagree with this order and both parties plan to lodge separate appeals to the European Courts in objection to the order.

The Government has also confirmed that in its view, and according to Irish tax legislation, Apple have paid the appropriate amount of Corporation Tax. It has also confirms that no state aid was provided.

The EC has provided very limited information supporting its decision on this matter which is resulting in serious questions in relation to the validity and calculation of the tax deemed to be due to the Irish State. It is likely to be several months before the detailed reasoning supporting the decision is published by the EC.

What does this mean for Ireland and its relationship with the EU?

The Irish Corporate Tax rate, together with other factors is critical in terms of our attractiveness as an economy for Foreign Direct Investment (FDI). In theory each EU Member State is free to set their own individual tax rates for each category of tax arising in each country. However, for some years now the Irish Government has come under considerable attack from other EU Member States, but particularly France, to increase its headline Corporate Tax Rate above the existing 12½%. The Irish Government has been forced to strongly defend Ireland’s corporate tax rate against outside criticism from Europe and is resolute in its commitment in this regard.

If the appeal is lost and Ireland ultimately ends up receiving these funds as directed by the EC then in effect the EU will have taken steps which enable them to interfere in and have the potential to exert influence over tax law. If this were to transpire foreign multinationals may change their perspective of Irish tax laws and no longer regard Ireland as a suitable location for FDI purposes. This could have potentialy disastrous economic consequences for the Irish economy in the future.

We believe the Irish Government are absolutely right in fighting this decision by the EC and proceeding with an appeal to the European Courts in order to defend Ireland’s position in this regard. However, any appeal that takes place will extend the matter for many years before a ruling is received from the European Courts.

Images: Shutterstock

Reasons To Do Business In Ireland – Corporate Tax Rates and Tax Administration

-

Corporate Tax Rate of 12.5%

-

Overall Tax Rate

| Category | Ireland | Germany | Italy | France | ||||

| Profit Taxes | 12.4% | 23.3% | 19.9% | 7.4% | ||||

| Labour/Employer Taxes | 12.1% | 21.2% | 43.4% | 51.7% | ||||

| Other Taxes | 1.4% | 4.3% | 2.1% | 7.5% | ||||

| Total Tax Rate | 25.9% | 48.8% | 65.4% | 66.8% | ||||

-

Bureaucracy and Administration

-

Three Year Exemption From Corporate Tax For Start-Up’s