News Income Tax

Non-Resident Landlord Withholding Tax (NLWT) System

Budget 2023 – What does it mean for your Business?

- Each PAYE worker/sole trader in the higher tax band will see tax savings in 2023 of over €800 over the course of the year with the following measures:

- increase of the standard rate band to €40,000,

- increase of personal, employee and earned income tax credits by €75 each, and

- increase in the 2% USC rate threshold by €1,625.

- A tax credit for those who are renting of €500 per annum including for the year 2022.

- Electricity credits of €600 of which €200 will be paid in December 2022 with the remainder early in the new year.

- There were a number of increases for social welfare recipients including:

- Social welfare payments to be increased by €12 per week;

- One off double week payment to social welfare recipients in October in addition to the Christmas bonus in December;

- One off payment of €200 for those in receipt of the Living Alone Allowance;

- One off payment of €500 to those on Disabililty Allowance, Invalidity Pension and Blind Pension;

- One off payment of €500 to those on Carer’s Support Grant.

- Parents will benefit greatly in this budget with the following items being introduced

- A 25% weekly reduction for those availing of the National Childcare Scheme

- A once off double payment of child benefit to all qualifying households

- Free school books to be provided for primary school children.

2019 Income Tax Deadline – Extension to 10th December 2020

Some Highlights of Budget 2020

- Income tax rates and bands and the USC rates and bands remain unchanged. The Minister for Finance did not want to commit to personal tax cuts in the lead up to a no-deal Brexit.

- The Home carer credit has increased to €1,600 and the Earned income credit has increased to €1,500.

- The Group A threshold for CAT has increased from €320,000 to €335,000. The increased threshold applies to gifts or inheritances received on or after 9 October 2019.

- There was no mention of employer’s PRSI however Budget 2019 announced this would increase from 10.95% to 11.05% from 1 January 2020. Employer’s PRSI has steadily increased over the last few years and represents a significant cost to businesses.

- SARP relief and the Foreign Earnings Deduction have been extended to 31 December 2022.

- In 2018, the Government implemented a 0% BIK rate for electric vehicles subject to a value limit of €50,000 in comparison to a rate of 30% of the car’s original market value for non-electric vehicles. This initiative has been extended to 2022.

- An increase in the credit from 25% to 30%.

- The ability to claim the credit on qualifying expenditure before the company commences trading. It should be noted that any credit claimed in this period can only be offset against VAT and payroll liabilities.

- An increase in the outsourcing limit applicable to third level institutes from 5% to 15%.

- Farm restructuring relief, a capital gains tax relief due to expire at the end of this year, has been extended to 31 December 2022.

- Several amendments will be made to the KEEP scheme to incentivise take-up in the scheme. This includes a change in the definition of a qualifying company so that the scheme applies to group structures and a change in the definition of a qualifying individual so that it applies to part-time and flexible employees.

- EII relief, an income tax relief for individuals who invest funds in certain companies, will also undergo changes which apply from yesterday. The amendments will allow individuals to claim full relief in the year of investment and the annual investment limit will increase from €150,000 to €250,000.

- The Minister for Finance announced there will be a significant overhaul to the DWT regime. From 1 January 2021, real-time date collected under the new PAYE Modernisation regime will be used to create a personalised rate of DWT on distributions received by individuals. In the meantime, an increase in the DWT rate from 20% to 25% will apply from 1 January 2020.

SME’s Welcome Changes to Subsistence Allowance Rates

- Employees and directors can now claim back an additional 10% of the costs incurred completely Tax Free while travelling on business.

- The cost to companies is considered to be an allowable expense for Corporation tax purposes, meaning it can be deducted from taxable profits.

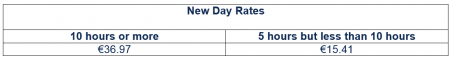

- The daily subsistence ‘5 Hour but less than 10 Hour’ rate increases by 10%.

- The daily subsistence ‘10 hours or more’ rate increases by 10%.

- The increases are in line with the Consumer Price Index.

- The revised standard rates of subsistence allowance are effective from 1 July 2019.

What remains unchanged?

What remains unchanged?

- The standard overnight rate will not be increased.

- A separate Vouched Accommodation (VA) rate continues to apply whereby employees encounter difficulties in sourcing suitable accommodation in Dublin.

For more information please contact a member of our team or email us at info@robertsnathan.com

For more information please contact a member of our team or email us at info@robertsnathan.com 3 Key Points about the Earned Income Tax Credit

As the old saying goes…“there are only two things in life you can’t avoid – death and taxes!”, but are you sure you’ve been claiming all the credits you’re entitled to?

2016 saw the introduction of the Earned Income Tax Credit. The credit, worth €550 in 2016, and €950 in 2017. It aims to reduce the disparity between self-employed and PAYE workers.

The credit applies to self-employed individuals and directors who cannot claim the PAYE credit.

Below we have outlined three of the most important points about the Earned Income Tax Credit:

1. No Salary = No Credit

If you are self-employed or a director, not entitled to the PAYE credit, then you may be entitled to the Earned Income Credit. However, to avail of the full amount of the credit you must take a salary of at least €4,750 in 2017. Anything less than €4,750 in 2017 may only qualify for a reduced tax credit.

2. PAYE Credit & Earned Income Credit

If you have PAYE income and self-employment/directorship income then the combined value of both tax credits cannot exceed €1,650, i.e. you cannot have the full value of both credits.

3. Spouses

Where the spouse of a director of a company receives a salary from that company he/she is not entitled to claim a PAYE credit. However they may be entitled to claim the Earned Income Credit (see Example 1 below).

Example 1 – Spouses and tax credits

Joe and Mary are a married, Joe is a director of ABC Ltd with a 20% shareholding. Mary also works for ABC Ltd in payroll department.

Joe and Mary receive annual salaries of €70,000 and €45,000 respectively.

| Joe | Mary | Total Additional Credits | |

| PAYE System | No credit | No credit | - |

| Earned Income Credit | €950 in 2017 €550 in 2016 | €950 in 2017 €550 in 2016 | €1,900 in 2017 €1,100 in 2016 |

Top Tip!

If you or your spouse is a director of a company, without another source of income, you/they can take a salary from the company of up to €4,750 in 2017 completely tax free.

Unsure about your tax credit entitlements? Contact a member of our team here, they’ll be happy to help!

Images: Shutterstock

Offshore Matters – 4 Target Areas

On the first of May, in just seven weeks’ time, a governmental amnesty will expire. Once May 1st passes, Revenue will initiate an enthusiastic clampdown on offshore assets. Their message between now and the end of April is clear: if you do not avail yourself of the amnesty period and attempt to circumvent Revenue’s requirements, you will be found and you will pay a substantial price; new legislation means penalties for non-disclosure will increase dramatically. If you have already completed your Income Tax returns and declared all your source of income, then no further action is required.

Here are the essential points to bear in mind, for Irish tax residents:

1. Penalties may Increase to 100%

A penalty of 100% of the total underpaid tax in addition to the requirement to settle the tax bill itself. In other words, you can pay 100% on your liabilities now plus interest, or face paying up to 200% plus interest of them from May onwards. This rate will apply to all defaulted tax, whether offshore or on-shore.

2. Offshore Accounts

At the very top of Revenue’s new “to do” list is offshore matters, and specifically undeclared offshore accounts. A number of Roberts Nathan’s clients have had a letter at this stage from Revenue asking for details about any undeclared assets which might be eligible for Irish income tax, and offshore accounts are their top priority.

Additionally, any accounts in foreign bank accounts which have been transferred to an Irish account for any reason whatsoever is a remittance, and must be declared.

For example, a married couple who decided to move from America to Ireland to retire and are now tax resident in Ireland. They have two banks accounts one in Ireland and one in America. The American bank account receives their State pensions from the American Government. What must they declare to Revenue?

Transaction 1: They visit family in New York and use the money from their American bank account during their trip. This does not need to be declared to Revenue as the money never entered Ireland.

Transaction 2: The couple decide to buy a new car in Ireland, they transfer $25,000 from their American account to their Irish bank account. This must be declared to revenue as the monies have entered the State, the couple will be liable to income tax on this transaction.

3. Non-residential Property held Abroad

Very much included in the scope of the upcoming crackdown is undeclared properties held outside the State. Your holiday home in the south of Spain doesn’t qualify unless it generates rental income, but the apartment which you rent to students in London or that warehouse you lease to a mechanic in Florida most assuredly do! If any property holdings anywhere in the world generate income, they absolutely must be declared by May 1st.

4. Business Interests

Likewise, any and all business interests in any part of the world have to be disclosed to Revenue and all liabilities paid before the deadline. This includes partnerships, ownerships, shareholdings, or any other stake in any business.

We’re advising anyone who holds business interests, properties or any other investments abroad to ensure the detail is properly reported to Revenue before the amnesty runs out. Moreover, the sooner the better for everyone: there’s still time to correct any irregularities, but from the beginning of May onwards, those avenues will be closed off.

You may have already disclosed all the necessary information on your income tax return, in which case you can sleep easy knowing your tax affairs are in order. However, if you are unsure of your tax obligations, have any queries in relation to the above, or if you require assistance in amending your returns, please do not hesitate to contact a member of our team, here. They’ll be happy to help!

Images: Shutterstock

Did you know there is Tax Relief for Coeliacs and Diabetics?

Tax Relief

As anyone who is restricted to a coeliac or diabetic diet will attest, it is significantly more expensive to purchase such specialised foods. And while they are becoming more easily available in supermarkets across Ireland, the cost on average can be twice as much as standard food shop. However, there is tax relief of 20% available on the cost of such foods.Do I qualify for the relief?

To qualify for tax relief you will need:- To be diagnosed by your doctor as a diabetic or coeliac,

- A letter from your doctor stating that they have advised you to maintain a diabetic or coeliac diet.

How do I avail of the relief?

To obtain the 20% tax relief you simply include the cost of your product purchases from supermarkets, along with any other medical expenses for the year in your income tax return.Example

Jack is a coeliac who, on the advice of his doctor, is following a gluten-free diet. He has receipts for gluten-free products totalling €4,200 and other medical receipts (doctor visits and prescriptions, not claimed under health insurance) totalling €2,080. Jack is entitled to claim for tax relief of €1,256* for 2016. *(€4,200+€2,080 = €6,280 x 20% = €1,256) If you would like further information on this tax relief please do not hesitate to contact a member of our team they’ll be happy to help you!Tips To Reduce Your Income Tax Liability

Well, it’s that time of the year again. The Income Tax deadline is fast approaching and no doubt those of you are required to file a return are busy gathering information to forward to your accountant or tax advisor. With the knowledge and experience acquired over the past few years working with our clients we have put together some of the key Income Tax deductions, credits, allowances and reliefs which you may be able to claim to help reduce your Income Tax liability.

1. Health Expenses

One of the main tax reliefs claimed by individuals are medical expenses, which may be claimed at the standard rate of 20%. Examples of claimable medical expenses include:

- Qualifying medical expenses i.e. prescribed on the advice of a qualifying practitioner.

- Drugs or medicines prescribed by a practitioner.

- Qualifying dental expenditure, which must be accompanied by a Form Med 2 (Routine dental treatment such as extraction, scaling and fillings are not allowable expenses.)

In addition to the above, any payments made to a nursing home for the full time care of an individual will provide relief at the Income Tax Rate of up to 40%.

2. Qualifying Tuition Fees paid in 2015

If you have children in third level education you will more than likely have paid a significant amount in tuition fees. The good news for Income Tax purposes is that you can claim a deduction against your Income Tax Liability at the 20% rate. The deduction may be claimed on the 2015 academic year tuition fees paid, including student contribution. The maximum limit on qualifying fees paid for the academic year 2014/2015 is €7,000 per individual per course. Unfortunately when calculating the relief, the first €3,000 is disregarded and only the balance is available for relief at 20%.

3. Home Carer’s Tax Credit

If you are jointly assessed and you or your spouse/civil partner is a home carer you may be entitled to claim a Home Carer’s Tax Credit. For the tax year 31st December 2015 the credit amounts to €810 and may be claimed if care is provided for:

- A child whom you are entitled to Social Welfare Child Benefit;

- A person who is permanently incapacitated by reason of mental or physical infirmity and such person normally resides with you for the year or;

- A person aged 65 or over.

4. Retirement Annuity Contracts (RAC’s)

If you are thinking of topping up your pension you can avail of Tax relief on RAC premiums paid, including any premiums paid between 1st January 2016 and the return filing date. When deciding on the amount of an RAC contribution you would like to make you must consider two main factors:

Age related percentage limit – This provides for a maximum contribution of your Net Relevant Earnings (NRE)*. For example a person under 30 years of age can make a contribution of 15% of their NRE, with a person aged 60 and over being able to make a contribution of 40% of their NRE.

Upper Limited on NRE – There is an upper earnings limited of €115,000 for 2015 and applies whether an individual is contributing to a single pension product or multiple products.

*NRE are your earnings, less any allowable expenses. For example, if you have a sole trade profit of €80,000 and capital allowances of €10,000 the NRE is €70,000.

5. Personal Retirement Savings Accounts (PRSAs)

Payments made to PRSAs will benefit from tax relief at the individuals highest Income Tax rate. As with RAC’s above the maximum contribution is linked to your age so it is important to include your date of birth in the personal details section of the Income Tax Return.

6. Employment and Investment Incentive Relief, replacing Business Expansion Scheme

This relief can be claimed as a deduction against your total income, before tax credits and allowances, thus reducing your Income Tax at the higher rate. The maximum relief claimed in any tax year is €150,000 with a minimum of €250. If full relief cannot be claimed in the year that monies were invested the excess can be carried forward, but no later than 2020, subject to the above maximum limits. Before a claim can be made you must secure a RICT 3 as you will be required to include the RICT 3 certificate number or Designated Funds reference number on your Income Tax Return.

7. Maintenance Payments and Deeds of Covenants

Tax Relief may only be claimed on maintenance payments made under a legally enforceable arrangement for the benefit of the spouse or civil partner. Relief is not granted on payments for children.

If you have a deed of covenant in place in favour of permanently incapacitated minor, other than your own child, where the recipient is under 18 years of age and unmarried, unrestricted relief may be granted against your Income Tax Liability. Relief is also available for covenants in favour of permanently incapacitated adults with restricted relief available on covenants in favour of adults aged 65 and over.

8. Employing a Carer

Tax relief can be claimed at the higher rate of tax if you employ an individual to care for an incapacitated person. This relief cannot be claimed in conjunction with the Dependent Relative Tax Credit or the Incapacitated Child Tax Credit. The relief to be claimed is the cost of employing the carer, subject to a maximum of €50,000, less any amounts recovered from a health or local tax authority. If two or more people employ the carer, the relief is apportioned between them.

To find out more on how to reduce your Income Tax Liability please do not hesitate to contact one of our team here.

Images: Shutterstock

Tips To Reduce Your Income Tax Liability

-

Health Expenses

- Qualifying medical expenses i.e. prescribed on the advice of a qualifying practitioner.

- Drugs or medicines prescribed by a practitioner.

- Qualifying dental expenditure, which must be accompanied by a Form Med 2 (Routine dental treatment such as extraction, scaling and fillings are not allowable expenses.)

-

Qualifying Tuition Fees paid in 2014

-

Home Carer’s Tax Credit

- A child whom you are entitled to Social Welfare Child Benefit;

- A person who is permanently incapacitated by reason of mental or physical infirmity and such person normally resides with you for the year or;

- A person aged 65 or over.

-

Retirement Annuity Contracts (RAC’s)

Age related percentage limit – This provides for a maximum contribution of your Net Relevant Earnings (NRE)*. For example a person under 30 years of age can make a contribution of 15% of their NRE, with a person aged 60 and over being able to make a contribution of 40% of their NRE.

For example, if you are aged 28, have earned €45,000 and made a contribution of €7,000 the relief is restricted to €6,750 (€45,000 * 15%). The remaining €250 may be carried forward to the following year.

Upper Limited on NRE – There is an upper earnings limited of €115,000 for 2014 and applies whether an individual is contributing to a single pension product or multiple products.

*Your Net Relevant Earnings are your earnings, less any allowable expenses. For example, if you have a sole trade profit of €80,000 and capital allowances of €10,000 the NRE is €70,000.-

Personal Retirement Savings Accounts (PRSAs)

-

Employment and Investment Incentive Relief, replacing Business Expansion Scheme

-

Maintenance Payments and Deeds of Covenants

-

Employing a Carer

Submitting Your Income Tax Return

Under the pay and file self assessment system for Income Tax you must complete the following before 31st October 2015:- File your 2014 Income Tax Return

- Pay any balance of Income Tax outstanding for 2014

- Pay your Preliminary Tax for 2015