News VAT

Budget 2023 – What does it mean for your Business?

- Each PAYE worker/sole trader in the higher tax band will see tax savings in 2023 of over €800 over the course of the year with the following measures:

- increase of the standard rate band to €40,000,

- increase of personal, employee and earned income tax credits by €75 each, and

- increase in the 2% USC rate threshold by €1,625.

- A tax credit for those who are renting of €500 per annum including for the year 2022.

- Electricity credits of €600 of which €200 will be paid in December 2022 with the remainder early in the new year.

- There were a number of increases for social welfare recipients including:

- Social welfare payments to be increased by €12 per week;

- One off double week payment to social welfare recipients in October in addition to the Christmas bonus in December;

- One off payment of €200 for those in receipt of the Living Alone Allowance;

- One off payment of €500 to those on Disabililty Allowance, Invalidity Pension and Blind Pension;

- One off payment of €500 to those on Carer’s Support Grant.

- Parents will benefit greatly in this budget with the following items being introduced

- A 25% weekly reduction for those availing of the National Childcare Scheme

- A once off double payment of child benefit to all qualifying households

- Free school books to be provided for primary school children.

Artists Exemption (Income Tax and VAT Implications)

- Arts Council Bursaries when paid directly to individuals by the Arts Council.

- Residencies when paid directly to the individual by the Arts Council for the purposes of producing a qualifying work. (Income from residencies which relate to teaching art or facilitating other individuals to create works of art or similar type practices do not qualify for exemption.)

- Cnuas payments under the Aosdana Scheme.

- Payments from the sale of qualifying works abroad, which fall within the guidelines.

- Advance royalties.

Debt Warehousing

- Period 1 - COVID-19 restricted trading phase

- Period 2 – Zero interest period

- Period 3 – Reduced interest period

- Period 1 - COVID-19 restricted trading phase

- Period 2 - Zero interest period

- Period 3 - Reduced interest period

UK Businesses – Do you have the correct Irish VAT number?

| No, invalid VAT number for cross border transactions within the EU |

Real Brexit 1 month in – From IT services to dresses to skincare and live Horses the VAT implications

The (European Union) EU and the United Kingdom (UK) finally reached agreement on a Free Trade and Cooperation Agreement (TCA), avoiding a hard Brexit at the end of December. However, this does not change the fact that the UK has left the EU and therefore is no longer part of the EU single market and customs union and is now regarded as a third country.

The first real trading weeks since the UK departure have highlighted the very real issue for a number of clients and new contacts we are assisting on VAT matters. From understanding how VAT now applies on point of entry on the movement of goods and whether to remain as the ‘Importer of Record’ to the UK for Irish businesses. We have been advising Irish and UK based clients from a wide range of sectors around VAT treatments on trading from ladies dresses to skincare products and from IT services to live horses all in the last few weeks as trade items start to move between the UK and Ireland. Including assisting with potential registration for UK VAT with HMRC by Irish traders. If your business needs advice in these areas for B2B or B2C transactions between the UK and Ireland please contact us at dublin@robertsnathan.com or cork@robertsnathan.com and we can assist.Is there still value in UK car imports post-Brexit?

- Complete a customs electronic declaration

and

- Pay Customs duty and Value-Added Tax.

Used vehicles

In the event of a no-deal Brexit, the procedures for vehicle registration will remain unchanged for a period of 30 days. This is to facilitate the registration of vehicles imported pre-Brexit but whose registration appointments are scheduled for post-Brexit. After this period you will have to present a customs import declaration to register your vehicle.New vehicles

If you are importing a new vehicle into the State it must always be accompanied by the following:- A valid Certificate of Conformity (CoC) that confirms European Union type-approval. Please note that the type approval number on the CoC must correspond to an EU Member State.

- An Individual Approval Certificate or Small Series Approval Certificate issued by the National Standards Authority of Ireland (NSAI).

Potential VAT and Customs Duty implications of trade with the UK post-Brexit

VAT Compensation Scheme for Charities

The amount of VAT compensated is determined by the following formula:

A x B/C

A = Total VAT paid on qualifying expenditure B = Total qualifying income C = Total income

Please note the following; - Qualifying expenditure includes expenses incurred solely for the charitable purpose. - Qualifying income is the total income excluding publicly funded income (such as Government grants, EU grants etc.). Revenue has advised that the minimum VAT reclaim amount is €500 and claims for less than this amount will not be accepted.

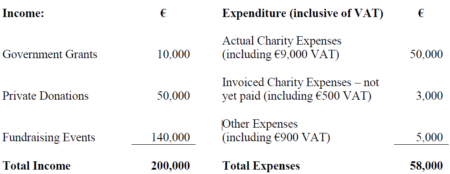

The Scheme’s Annual Cap The Revenue Commissioners have also advised that there is a €5 million cap on the scheme, which is to be reviewed after the first three years, this cap may result in the VAT repayment to charities being lower than the calculated amount. Other Considerations for Charities Availing of the Scheme Charities should be aware that in order to receive the VAT refund they are obliged to: - Keep evidence of their invoices/receipts for a period of 6 years. - Have tax clearance issued by the Revenue Commissioners. - Provide the Revenue Commissioners with the most recent set of audited Financial Statements, if requested. Finally, it is important to note that the scheme works on the cash receipts basis, i.e. you can only make a reclaim for costs that have been paid (not just invoiced expenses). Example A charity has the following sources of income and expenditure for the year ended 31st December 2018: The charity would be entitled to a VAT reclaim under the new scheme as follows: A x B/C

A = €9,000 (i.e. the VAT on the expenses incurred for the charitable purpose only)

B = €190,000 (i.e. total income less government grants)

C = €200,000 (i.e. total income including government grants)

€9,000 x €190,000/€200,000 = €8,550

The charity is entitled to make a VAT reclaim under the scheme for €8,550. This claim must be made by 30th June 2019.

If you’d like to know more on how this scheme can work for your charity, please do not hesitate to contact us and one of our tax experts will be happy to help!

The charity would be entitled to a VAT reclaim under the new scheme as follows: A x B/C

A = €9,000 (i.e. the VAT on the expenses incurred for the charitable purpose only)

B = €190,000 (i.e. total income less government grants)

C = €200,000 (i.e. total income including government grants)

€9,000 x €190,000/€200,000 = €8,550

The charity is entitled to make a VAT reclaim under the scheme for €8,550. This claim must be made by 30th June 2019.

If you’d like to know more on how this scheme can work for your charity, please do not hesitate to contact us and one of our tax experts will be happy to help! VAT Invoicing

With Halloween just around the corner, the most frightening thought to small businesses and sole traders is the upcoming VAT return. VAT invoices, rates and credits – it’s the stuff of a true nightmare realm.

So what exactly is VAT? What needs to be included in a valid VAT invoice? And what is the difference between zero-rated and VAT exempt?

Value Added Tax (VAT)

Value Added Tax (VAT) is a European tax on consumer spending. You are required register for VAT if you have sales of goods exceeding €75,000 or sales of services of €37,500.

The rates of VAT applicable in Ireland are:

| Rate | Example |

| Zero-Rated | Exports, children’s clothing and footwear and certain food and drinks |

| 4.8% | Supply of livestock. |

| 9% | Restaurants and catering, and certain tourism supplies. |

| 13.5% | Cleaning, maintenance and certain fuels. |

| 23% | Standard rate which applies to any taxable supply not covered by an above rate. |

It could be said that Revenue employs business owners and sole traders like unpaid tax-collectors through the use of VAT returns. Depending on your circumstances Revenue may require you to make bi-monthly, tri-annual, bi-annual or annual VAT returns.

The idea behind VAT is that only the final customer actually pays it. To enable this suppliers receive input and output VAT credits. Suppliers must declare the amount of VAT they collected on sales (output credit) on their VAT return, however if they have paid VAT on business related purchases they are entitled to claim an input credit for that amount. The net effect of this means they will either have:

- VAT Payment - The amount of VAT you collected on sales is greater than the amount of VAT spent on business related purchases.

- VAT Refund - The amount of VAT you collected on sales is less than the amount of VAT spent on business related purchases.

VAT Invoices

Issuing incorrect VAT invoices can be a costly error, legislation provides for fines of €4,000 payable per incorrect invoice. The following information must be shown on a VAT invoice for it to be deemed valid:

- The date of issue of the invoice;

- A sequential number that uniquely identifies the invoices;

- The supplier’s full name, address and VAT registration number; and

- The purchaser’s full name and address.

In the case of a “reverse charge” supply of goods or services to a VAT registered customer in another EU Member State the following information is also required:

- The customer’s VAT number;

- An indication that the “reverse charge” applies;

- The quantity/volume of goods;

- The date the goods or services were supplied;

- The unit price exclusive of VAT (including any discounts or price reductions);

- A description of the goods or services;

- The consideration exclusive or VAT;

- The rate(s) of VAT; and

- The amount of VAT (at each rate if more than one applies).

Zero-Rated versus VAT Exempt

While it is a common mistake to think that zero-rated and VAT exempt are one-in-the-same, there is one significant difference, which has seen many individuals incorrectly over-claiming VAT credits.

Zero-rated VAT means that a supplier is required to charge VAT on sales at 0%. Therefore because the supplier is charging VAT on sales they are entitled to claim VAT on their purchases, even though they do not generate any actually VAT on sales.

VAT exempt on the other hand means the supplier is not required to charge VAT at any rate on sales, and thus is not eligible to reclaim the VAT on their purchases.

Ensuring that you and your company are VAT compliant can alleviate the fear of filing VAT returns. So this Halloween don’t let the thought of VAT send shivers down your spine. If you need any help or advice in relation to your VAT return please don’t hesitate to contact a member of our team, here, who will be happy to help.

Images: Shutterstock

How Managing Your VAT Can Assist With Cashflow

1. Paying VAT by Direct Debit

If you are registered for VAT you can avail of the direct debit scheme, on the basis that your bi-monthly VAT liabilities do not exceed €50,000 (€300,000 on an annual basis). The benefit of paying by direct debit is that it allows you to spread the cost of your VAT liability throughout the year, rather than having to source finance to cover fluctuations on VAT liabilities on a bi-monthly basis. In addition, when paying by direct debit you will no longer be required to prepare and submit bi-monthly VAT 3 returns, as the Revenue Commissioners will only require you submit an annual VAT return. If paying your VAT by direct debit you will be required to estimate the projected liability for the 12 months ahead with such an estimate divided by twelve to provide you with your monthly payments. It is important that you ensure the direct debits are sufficient to cover the annual liability as if the direct debit payments amount to less than 80% of your actual liability interest charges will be applicable and will be backdated to the midpoint of the year. In order to avoid interest charges you should review your VAT position on a regular basis to ensure your direct debits will be sufficient to cover your liability at the year end. If not, you should increase your direct debits to cover any shortfall.2. Cash Receipts Basis of Accounting for VAT

When returning VAT under the invoice basis you become liable for VAT on the raising and issuing of an invoice to a customer. However, under the cash receipts basis VAT is not required to be returned to the Revenue Commissioners until such time as you are paid by the customer, which can have a significant positive impact on your cashflow. Taking an example of an invoice which is raised on 31st October with a credit period of thirty days provided. In this example VAT would become payable under both the invoice and cash receipts basis as follows:| Invoice Raised | Funds Received | Returned in VAT 3 Period | VAT Payment Due by | |

| Invoice Basis | 31st October | 30th November | Sept/Oct VAT 3 | 19th November |

| Cash Receipts Basis | 31st October | 30th November | Nov/Dec VAT3 | 19th January |

3. Qualifying for Cash Receipts Basis of Accounting for VAT

In order to qualify for cash receipts basis of accounting for VAT one of the following criteria must be met:- Turnover must not exceed €2,000,000

- At least 90% of your customers are not registered for VAT or not entitled to claim a full deduction of VAT (e.g. shops, restaurant, public houses and similar business providing goods or services to the general public).

4. Managing Cashflow through Invoice Basis of Accounting for VAT

If you do not qualify for cash receipts basis, you can still effectively manage your cashflow by managing the dates on which you issue invoices. Taking the above example, if the invoice was issued on 1st November instead of 31st October then the VAT would be required to be returned in your November/December VAT 3, which would not become payable until 19th January. In this instance, payment should be received from the customer by 1st December, thus ensuring you are in receipt of payment before the VAT is payable to the Revenue Commissioners. If it is possible to issue an invoice one day later it can have a positive impact on your cashflow! However, be mindful not to push the issuing of invoices out too far as invoices must be issued within 15 days of the end of the month in which the goods or services are supplied.5. Reduced Filing of VAT Returns

Most businesses, when first established, will be required to return their VAT on a bi-monthly basis. However, you can apply to the Revenue Commissioners to reduce the frequency of your VAT returns in the following circumstances:- Businesses whose total annual VAT payment is less than €3,000 are eligible to file and pay VAT Returns on a six monthly basis.

- Businesses whose total annual VAT payment is between €3,001 and €14,401 are eligible to file and pay VAT Returns on a four monthly basis.