News

SME’s Welcome Changes to Subsistence Allowance Rates

The Minister for Public Expenditure and Reform has amended the standard rates of subsistence allowance in Ireland that apply to the Civil Service. This greatly benefits the private sector, as the Civil Services rates provide the benchmark for Revenue approved flat rate allowances.

The benefits are twofold:

- Employees and directors can now claim back an additional 10% of the costs incurred completely Tax Free while travelling on business.

- The cost to companies is considered to be an allowable expense for Corporation tax purposes, meaning it can be deducted from taxable profits.

What are the changes?

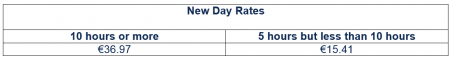

- The daily subsistence ‘5 Hour but less than 10 Hour’ rate increases by 10%.

- The daily subsistence ‘10 hours or more’ rate increases by 10%.

- The increases are in line with the Consumer Price Index.

- The revised standard rates of subsistence allowance are effective from 1 July 2019.

What remains unchanged?

- The standard overnight rate will not be increased.

- A separate Vouched Accommodation (VA) rate continues to apply whereby employees encounter difficulties in sourcing suitable accommodation in Dublin.

For more information please contact a member of our team or email us at info@robertsnathan.com