News Taxation

Thank your Employees with a Tax Free Gift this Christmas

| Employee Cash Benefit | €500 |

| Treated as net salary so must be re-grossed and taxed by the employer through payroll | €540 |

| Employer PRSI | €110 |

| Total Cost | €1,150 |

- It must be a non-cash bonus – Most companies opt for gift vouchers to avail of the Scheme.

- The gift voucher must be purchased from company funds – For example from the company bank account or credit card. You cannot purchase the voucher yourself and then seek reimbursement.

- Each individual can only receive one tax-free voucher per annum – Even if the full amount is not utilised. For example, if you give a voucher of €200 in May and €300 in December, the second will be liable to tax. To maximise the tax relief use the full €500 in one go.

- Employees avoid PAYE, PRSI and USC, and employers don’t have to pay PRSI.

- It’s a tax-efficient way of rewarding your staff as these payments can be deducted from year end profits when calculating the Corporation Tax liability.

- Owners/directors whose spouse is also an employee/director can effectively double their benefit to €1,000 in gift vouchers.

- It makes sense to use as a Christmas bonus as the voucher can only be gifted once a year.

Preliminary Tax – What is it?

- 100% of your previous year’s liability, OR

- 90% of your current year liability, OR

- 105% of your pre-preceding year’s liability.

- Individuals

| Income Tax Year ending 31st December 2018 | File and Pay your Income Tax by 31st October 2019 |

| Preliminary Tax for 2019 | File and Pay Preliminary tax by 31st October 2019 |

- Companies

| Accounting Year-end | 31st December 2018 |

| Corporation Tax Deadline | 23rd September 2019 |

| Preliminary Tax Deadline | 23rd November 2019 |

Some Highlights of Budget 2020

- Income tax rates and bands and the USC rates and bands remain unchanged. The Minister for Finance did not want to commit to personal tax cuts in the lead up to a no-deal Brexit.

- The Home carer credit has increased to €1,600 and the Earned income credit has increased to €1,500.

- The Group A threshold for CAT has increased from €320,000 to €335,000. The increased threshold applies to gifts or inheritances received on or after 9 October 2019.

- There was no mention of employer’s PRSI however Budget 2019 announced this would increase from 10.95% to 11.05% from 1 January 2020. Employer’s PRSI has steadily increased over the last few years and represents a significant cost to businesses.

- SARP relief and the Foreign Earnings Deduction have been extended to 31 December 2022.

- In 2018, the Government implemented a 0% BIK rate for electric vehicles subject to a value limit of €50,000 in comparison to a rate of 30% of the car’s original market value for non-electric vehicles. This initiative has been extended to 2022.

- An increase in the credit from 25% to 30%.

- The ability to claim the credit on qualifying expenditure before the company commences trading. It should be noted that any credit claimed in this period can only be offset against VAT and payroll liabilities.

- An increase in the outsourcing limit applicable to third level institutes from 5% to 15%.

- Farm restructuring relief, a capital gains tax relief due to expire at the end of this year, has been extended to 31 December 2022.

- Several amendments will be made to the KEEP scheme to incentivise take-up in the scheme. This includes a change in the definition of a qualifying company so that the scheme applies to group structures and a change in the definition of a qualifying individual so that it applies to part-time and flexible employees.

- EII relief, an income tax relief for individuals who invest funds in certain companies, will also undergo changes which apply from yesterday. The amendments will allow individuals to claim full relief in the year of investment and the annual investment limit will increase from €150,000 to €250,000.

- The Minister for Finance announced there will be a significant overhaul to the DWT regime. From 1 January 2021, real-time date collected under the new PAYE Modernisation regime will be used to create a personalised rate of DWT on distributions received by individuals. In the meantime, an increase in the DWT rate from 20% to 25% will apply from 1 January 2020.

Is there still value in UK car imports post-Brexit?

- Complete a customs electronic declaration

and

- Pay Customs duty and Value-Added Tax.

Used vehicles

In the event of a no-deal Brexit, the procedures for vehicle registration will remain unchanged for a period of 30 days. This is to facilitate the registration of vehicles imported pre-Brexit but whose registration appointments are scheduled for post-Brexit. After this period you will have to present a customs import declaration to register your vehicle.New vehicles

If you are importing a new vehicle into the State it must always be accompanied by the following:- A valid Certificate of Conformity (CoC) that confirms European Union type-approval. Please note that the type approval number on the CoC must correspond to an EU Member State.

- An Individual Approval Certificate or Small Series Approval Certificate issued by the National Standards Authority of Ireland (NSAI).

Potential VAT and Customs Duty implications of trade with the UK post-Brexit

SME’s Welcome Changes to Subsistence Allowance Rates

- Employees and directors can now claim back an additional 10% of the costs incurred completely Tax Free while travelling on business.

- The cost to companies is considered to be an allowable expense for Corporation tax purposes, meaning it can be deducted from taxable profits.

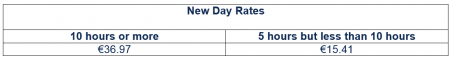

- The daily subsistence ‘5 Hour but less than 10 Hour’ rate increases by 10%.

- The daily subsistence ‘10 hours or more’ rate increases by 10%.

- The increases are in line with the Consumer Price Index.

- The revised standard rates of subsistence allowance are effective from 1 July 2019.

What remains unchanged?

What remains unchanged?

- The standard overnight rate will not be increased.

- A separate Vouched Accommodation (VA) rate continues to apply whereby employees encounter difficulties in sourcing suitable accommodation in Dublin.

For more information please contact a member of our team or email us at info@robertsnathan.com

For more information please contact a member of our team or email us at info@robertsnathan.com What is KEEP and when is it most effective?

Changes to Revenue Demand Letters

What is the Current Procedure?

While the Revenue Commissioners have not yet confirmed when the new procedures will be introduced, it is anticipated that the first of these changes will be implemented by the end of March 2019 and will impact the how taxpayers engage with them upon receipt of a Demand Letters. Currently, when a taxpayer has overdue liabilities they receive a demand letter detailing the amounts outstanding for each tax-head. The letters are issued by individual case workers and their contact information is available on the letter. Generally, the taxpayer will contact the caseworker and either pay the outstanding liabilities or enter into an instalment arrangement. In cases where the taxpayer does not engage with the Revenue Commissioners they are issued with a series of further demand notices, and it can take several months before a case is progressed to enforcement.What’s Changing?

From the end of March 2019 the Revenue Commissioners are changing their procedures for the collection of outstanding taxes. Taxpayers will now receive a 7-day notice demand letter, if the taxpayer has not engaged with Revenue within the 7 days the case will automatically be marked for enforcement. In addition to this demand letters will no longer be issued by a caseworker instead they will be automatically generated. The letters will contain a general helpline for taxpayers to contact.How will this Impact Me and My Business?

Essentially this change means that taxpayers, whether individuals, businesses or companies, will need to engage with the Revenue Commissioners if they receive a demand letter. It appears as though Revenue are hoping a new, more streamlined process will increase tax collections while also reducing the amount of time spent on chasing outstanding payments. If you would like further information on the above please do not hesitate to contact a member of our team, they will be happy to help!Bittersweet: What will a sugar tax mean for fans of fizzies?

In response to overwhelming evidence that sugars, not fats, are the greatest dietary threat to public health, governments in the developed world are beginning to implement measures aimed at countering the obesity, diabetes, heart disease, stroke, metabolic and hormonal disorders, dental destruction and even the adverse psychological and neurological effects of our sugarmania.

The Irish soft drinks industry has pushed back hard against plans to have a new sugar tax up and running by April of next year. They predict it will cut their income to the tune of €60 million annually, and that if the public’s habits do not change (we Irish are among the world’s greatest lovers of soft drinks), it will add about €60 a year to a household’s annual spend.

However, the scientific evidence is clear: sugar is very, very bad for us. Most of us in the developed world go through about 70kg of it a year...a far cry from the recommended maximum of about 13kg a year. We as a nation urgently need to cut out most of our sugar intake, and a sugar tax is the first step.

Doctors, scientists and politicians see Ireland on track to become Europe’s fattest, least-healthy nation within a decade if current trends do not reverse. Anti-tax advocacy groups - most notably the Irish Beverage Council and the Food and Drink Industry of Ireland – say similar taxes already in place around the world have shown no discernible public-health benefits. So, who’s hitting the sweet spot and who’s just feeling sour?

At a glance: Will the sugar tax be a bitter pill to swallow?

-

When will the Sugar Tax come into operation?

April 2018

-

Does this mean my favourite fizzy drink is going to shoot up in price?!

“Shoot up” might be a bit strong, though you’ll definitely notice a difference. Even if you really, really love fizzy drinks, the price increase won’t break the bank. For the rest of us, the evidence suggests that we’ll spend smartly, cutting back by just enough to see health benefits and spend the savings elsewhere.

-

What will this mean for my corner shop?

If evidence from comparable markets is to be believed, it means your corner shop will sell a little less in the way of fizzy drinks, and a little more in the way of bottled water, teas and infusions, nut-based drinks and milk. This isn’t going to drive anyone out of business.

-

What will this mean for my restaurant?

It means that you’ll sell fewer cans or bottles of fizzy drinks, but as they’re not a backbone of your business you needn’t worry too much. As your customers choose to drink less sugar, you’ll be able to judge how much you’re likely to sell and adjust your inventory accordingly. Your spend in the initial phase may well increase slightly, but fizzy drinks last a long time: your stock will regularise. You won’t find yourself suddenly stuck with sweet stuff you can’t shift.

-

What will this mean for the food and drinks industry?

They’ll have to move with the times, but for every cent lost to declining sugar sales, they’re likely to pick it up elsewhere. Cutting back on sugar may well end up saving them money in the long run too: we’re surprisingly adaptive in our tastes and industry experience shows that consumers are unlikely to pine for sugar, or even notice a slight lack of sweetness, if products see their sugar content lowered gradually.

-

What will this mean for the economy overall?

Less money spent on tackling the profound health effects of a high-sugar diet will mean more money available for spending elsewhere, meaning a gradual but identifiable boost for research, equipment, personnel, infrastructure and more. Fewer sugar-related illnesses (e.g. less diabetes, fewer heart attacks and strokes and improved psychological health) will mean a busier, more productive population, making more and spending more.

-

What will this mean for me as a consumer?

Unless you absolutely must drink several litres of fizzy drinks every week, then honestly not that much. Yes, there is evidence that sugar is addictive, but it’s not so habit forming that your life will be ruined without it and you’ll probably consume less without even realising it. You’ll initially spend a little more on fizzy drinks, and then you’ll begin to phase them out in favour of cheaper, healthier alternatives. Eventually, your risk of sugar-related illness and mortality will reduce. You’ll save money on medical expenses and dental expenses, and spend elsewhere.

Images: Shutterstock

Why do I have to Pay Preliminary Tax?

Do you ever feel like you’re constantly paying tax? You’ve just paid for last year and now Revenue is asking for a payment for next year! Of course, remaining tax compliant is of utmost importance so you pay the liability – but every year you ask yourself…

What exactly is this payment for? What happens if I don’t pay? And when does it need to be paid by?

This is known as Preliminary Tax, and all taxpayers, whether a self-assessment individual or a company, are liable to pay it. Preliminary Tax is calculated on either:

- 100% of your previous year’s liability, or

- 90% of your current year liability, or

- 105% of your pre-preceding year’s liability.

As estimating the current year’s liability can be both time-consuming and costly the majority of clients opt to pay 100% of the previous year’s liability.

What happens if I just don’t pay?

If you fail to return and pay your Preliminary Tax then you are liable to a series of penalties, interest and surcharges. The interest alone is charged at a daily rate of 0.0219%, and in addition to this a surcharge of 5% - 10% may be applied.

When Preliminary Tax due to be paid?

Preliminary Tax is due to be paid as follows:

1. Individuals

Self-assessment taxpayers are required to file and pay their Income Tax and Preliminary Income Tax liabilities as follows:

| Income Tax Year ending 31st December 2016 | File and Pay your Income Tax by 31st October 2017 |

| Preliminary Tax for 2017 | File and Pay Preliminary tax by 31st October 2017 |

Of course the above deadline may be extended to 10th November 2017 if you opt to file and pay using Revenue’s Online System (ROS).

2. Companies

The Preliminary Tax return and payment, for companies, is due 11 months after your accounting year end. For example, if the accounting year end is 31st December 2016:

| Accounting Year-end | 31st December 2016 |

| Corporation Tax Deadline | September 2017 |

| Preliminary Tax Deadline | November 2017 |

Don’t Forget!!

Even if you did not have a tax liability you may still be required to file a Nil Preliminary Tax Declaration on ROS.

If you are unsure about your tax obligations, or require assistance calculating your liability, please do not hesitate to contact a member of our team, they’ll be happy to help!

Images: Shutterstock